Driver Per Diem

Drivers may no longer deduct meal and incidental expenses on their own. They now look to the carriers to mitigate the economic loss by implementing a pay plan that allows drivers to receive a portion of their pay as per diem, exempt from FICA and state and federal income taxes. Not participating in a viable per diem program could cost drivers thousands each year.

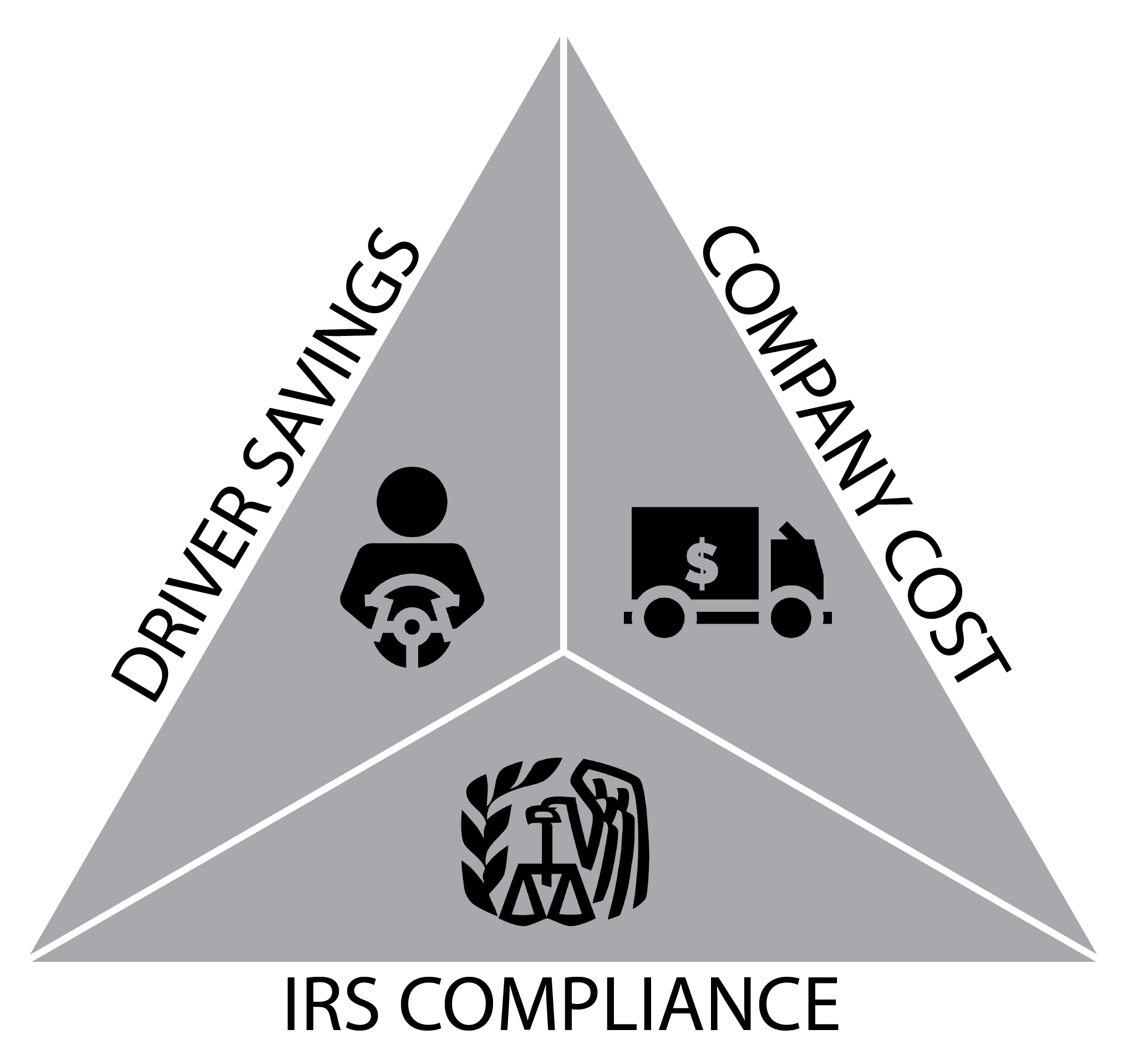

Fleetflo has implemented and maintained IRS compliant per diem programs for over 20 years. All of our per diem programs maintain the balance of IRS compliance, driver savings and company cost.

The FleetFlo Per Diem Process

- Fleetflo gathers fleet specific data to make sure we set per diem rates specific to your fleet that will maximize driver pay while keeping your program compliant.

- Fleetflo develops a roll-out plan specific to each fleet making the effort to not interrupt daily operations.

- We work with IT and payroll to most effectively implement per diem into the payroll systems.

- Fleetflo provides on-site training for those impacted by the per diem program and serves as an on-hand resource for all per diem questions.

- Fleetflo will draft letters and communications to most effectively communicate to the driver and provide proper education material.

- We provide access to our online per diem calculator where fleets and their drivers can see the impact per diem has on each driver individually.

- We review plans regularly and create monthly audit files to reduce IRS exposure and ensure compliance.

- Fleetflo reviews rates and will adjust as necessary to remain in line with IRS allowable amounts and fleet operations.

- Fleetflo continually reviews IRS regulations and statutes to ensure our carriers' programs are IRS compliant.

Per Diem Balance